Wonolo

One thing all freelancers have to worry about more than others is tracking expenses and payments. Without a steady paycheck, income is derived from multiple sources at irregular intervals and varying amounts. All of it needs to be invoiced separately, and it’s up to you to make sure you receive the proper payments on time.

Then there’s the self-employment tax you need to set aside, and quarterly tax payments to remember. Every business-related expense must be recorded with a receipt so that you can claim it as a deductible.

Not only does this take a lot of time, it can also get a bit overwhelming and confusing as you calculate expense after expense, trying to predict what your bank statement is going to look like so you can pay off rent, loans and credit cards.

Fortunately, as freelancing and contract work become more and more common, companies are developing tools specifically designed to tackle this problem.

Here are ten tools you can use to save yourself some financial hassle, listed in alphabetical order.

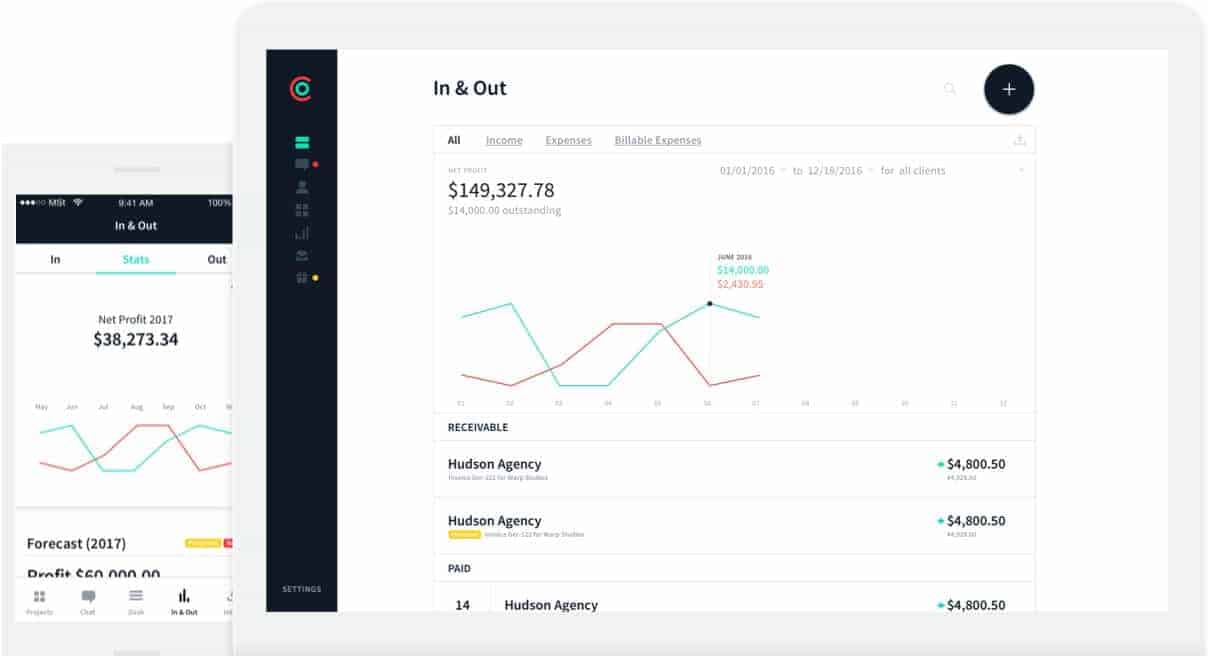

AND CO

Source: AND CO

Source: AND CO

AND CO is a tool that streamlines the freelance flow from proposal to payment. It’s also a great resource for topics related to freelance work.

The platform allows you to create and send customized contracts and invoices. It’ll also send out reminders for payments if your client hasn’t paid on time. You can accept payments through PayPal, credit card or ACH bank transfer.

If you’re looking for a service to alleviate the pain of invoice and payment tracking that’s also got a beautiful design, AND CO is a good option to consider.

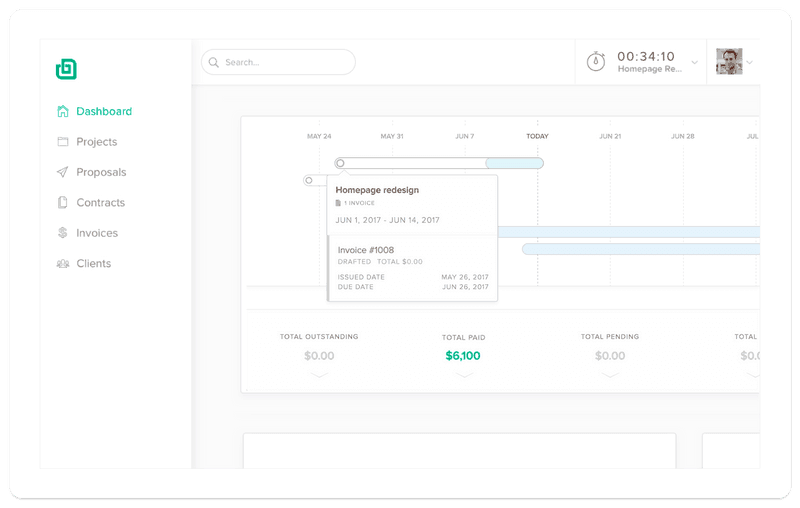

Bonsai

Source: Bonsai

A new player on the scene that emerged in 2016, Bonsai is a freelancer-friendly tool that creates contracts and invoices to make sure payments are made on time.

According to the founder Matt Brown, users get paid two weeks faster and experience fewer late payments than they had before using the tool.

It’s available internationally and supports multiple third-party payment processors including Stripe and PayPal. Additional features include time tracking and automated proposals.

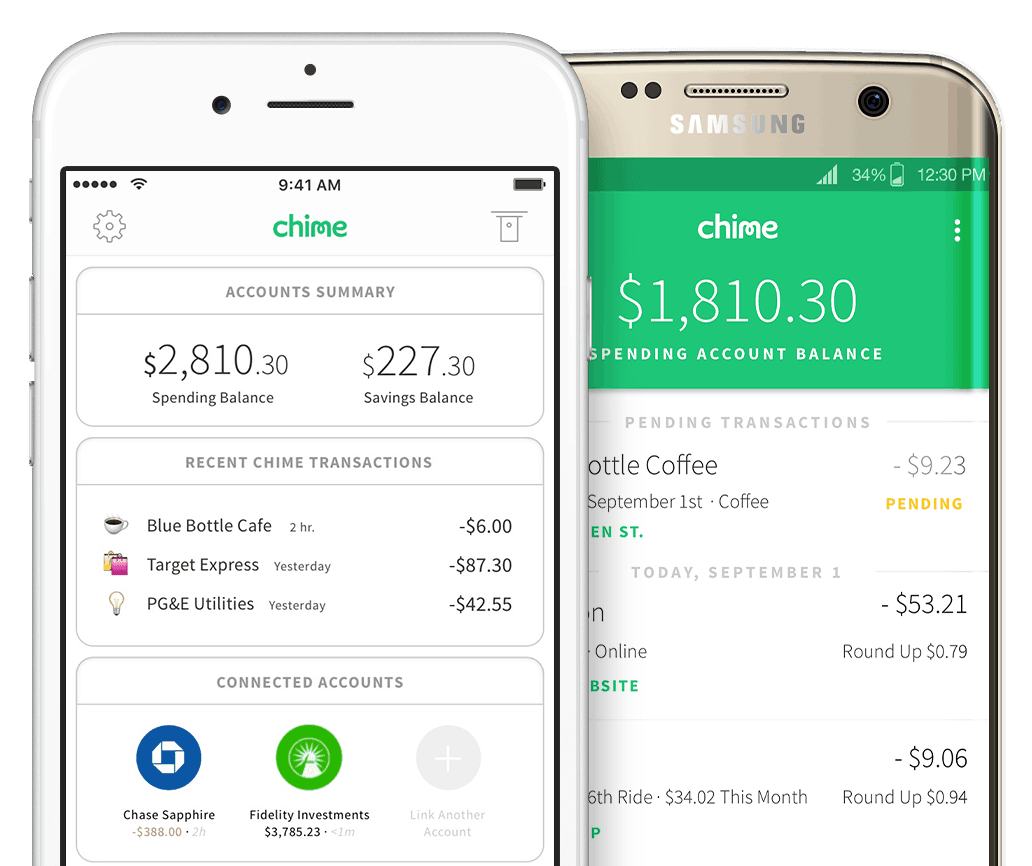

Chime

Source: Chime

As an online bank, Chime offers fee-free accounts that come with VISA debit cards. It doesn’t charge for foreign transactions or overdrafts, and there’s no minimum balance required

One of its notable features, apart from the no-fee deal, is its savings account. While it may not give you good interest rates, it does offer round ups, meaning that every purchase you made will be round up, with the extra cents going to your savings.

Chime also has cash back rewards and fee-free ATMs, which makes it a great account to have if you want to avoid fees and don’t want to use credit cards to prevent overspending and interest rates.

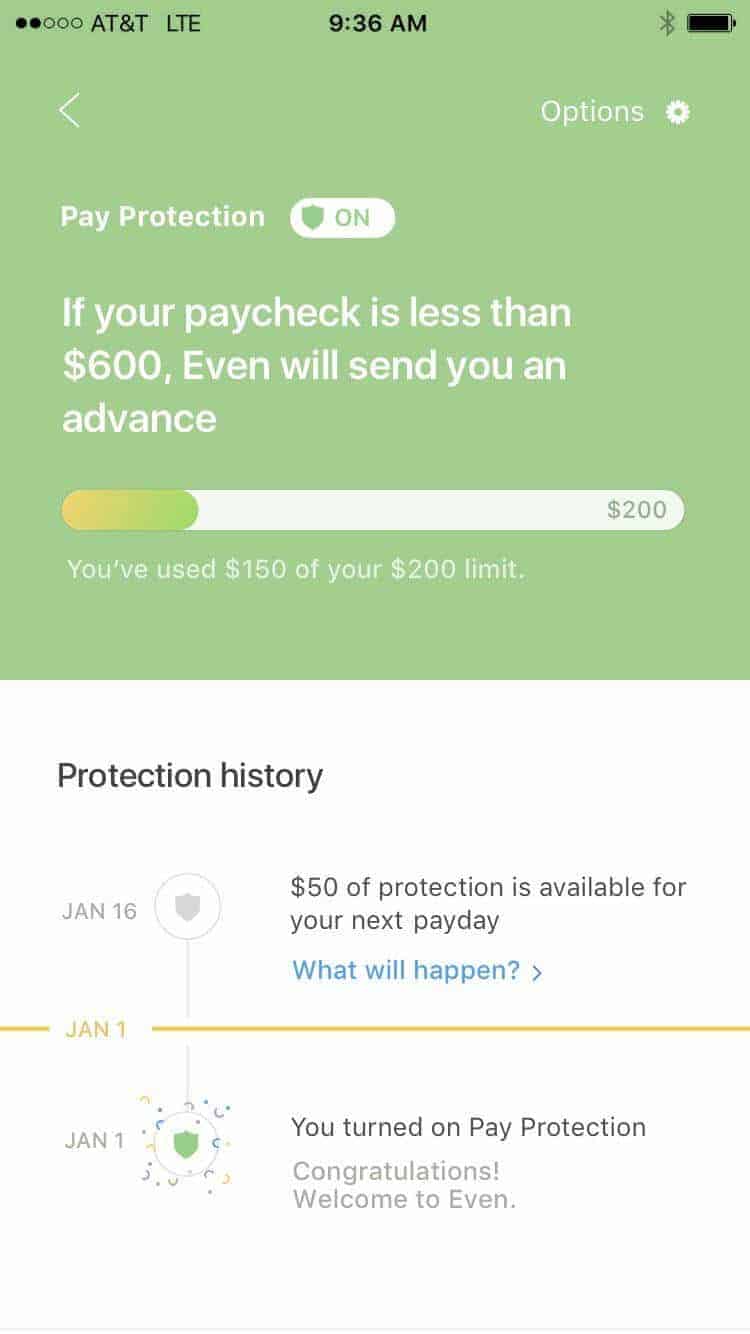

Even

Source: Even

If you like to plan ahead, Even is the banking app that allows you to predict your expenses and paychecks to keep things balanced and “even.” Based on your banking information, the app comes up with a financial plan and a simulated income stream for a given week.

The most unusual part about Even is its advance interest-free loan it deposits into your account if your weekly paycheck falls short. This means you won’t have to worry about overdrafts or credit card interest.

The app works this way because the founders specifically wanted to find a way to tackle income volatility. A Federal Reserve study found that a third of American households experience swings in income due to irregular hours. For freelancers and contractors whose hours are volatile, Even can be a very useful tool to have.

Goodbudget

Source: Goodbudget

In this era of technology, the envelope system – where you keep the cash for different spending categories in separate envelopes – might seem a little outdated. But if you want to budget effectively and not go over your monthly limit, it’s a good way to ensure you don’t spend more money than you’ve planned.

Goodbudget takes this method into the modern age in the form of an app. You’ll get virtual envelopes to fill each month by importing your bank account information, then dragging each transaction into appropriate envelopes/categories.

If you like to plan with your family, you can also sync your budget across multiple devices, allowing each member to have access to the budget at all times.

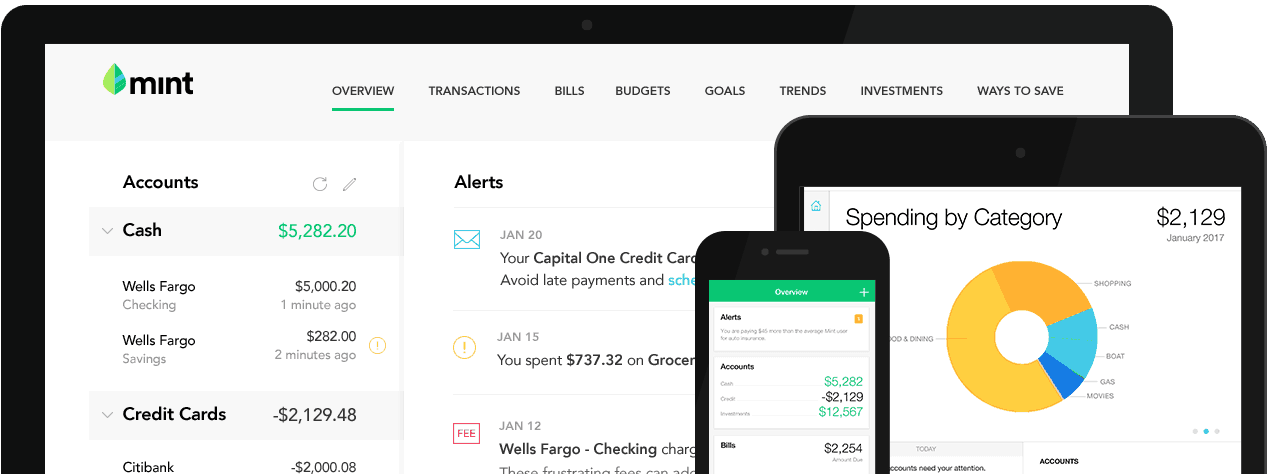

Mint

Source: Mint

Mint is a financial tracking app that allows you to see everything at a glance. You can pull information from your bank accounts, credit cards, savings and investment accounts to get a comprehensive overview.

You can set alerts and reminders, set monthly budgets and view detailed reports. Another beneficial feature is the free credit score, as well as customized recommendations based on Mint’s analysis.

It’s flexible, and the comprehensive function helps freelancers when they want to pull all their financial information into one place.

Moven

Source: The Financial Brand

Moven is a mobile banking app that also offers its own debit card. Since it’s specifically designed for mobile, its interface is clean and easy to use. There’s no minimum deposit and overdrafts aren’t allowed, so if you don’t have money in your account, the transaction simply doesn’t go through.

One of its most useful features is the notification you receive every time you use your debit card. This helps you keep track of your spending by making you more aware of how often and how much you spend on a given day.

While not a replacement for a regular bank account – checks and deposits take a long time to clear – it’s still good if you just want a simple tracker that notifies you upon each purchase.

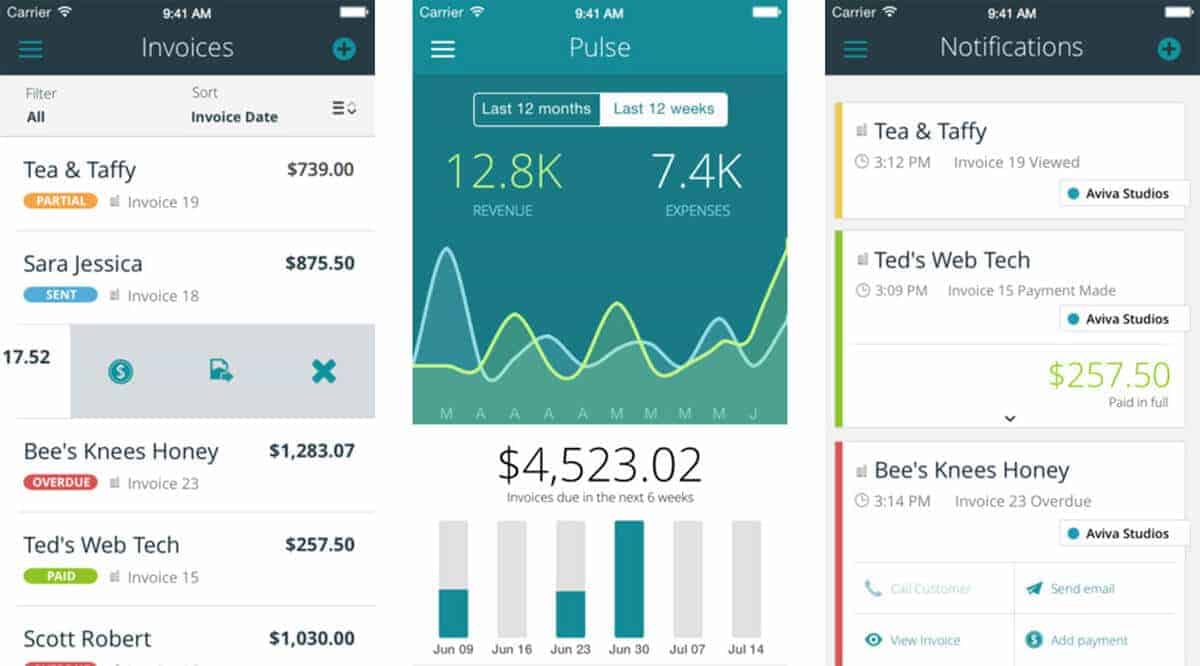

QuickBooks Self-Employed

Source: QuickBooks

QuickBooks Self-Employed is an accounting software that has all the features you need as a self-employed person, from invoicing to mileage tracking. Its mobile design lets you swipe your expenses away, simplifying the whole process and saving time.

For freelancers dealing with receipts, you can take photos of your receipts in the app and the software automatically logs the expense. It also allows payments with no-fee ACH bank transfers, speeding up the payment.

As an Intuit tool, QuickBooks allows you to sync your information to TurboTax to do your taxes. Even without this function, it calculates your quarterly tax payments for you so you know how much you owe in advance. Overall, it’s a powerful tool that takes care of all your freelance needs.

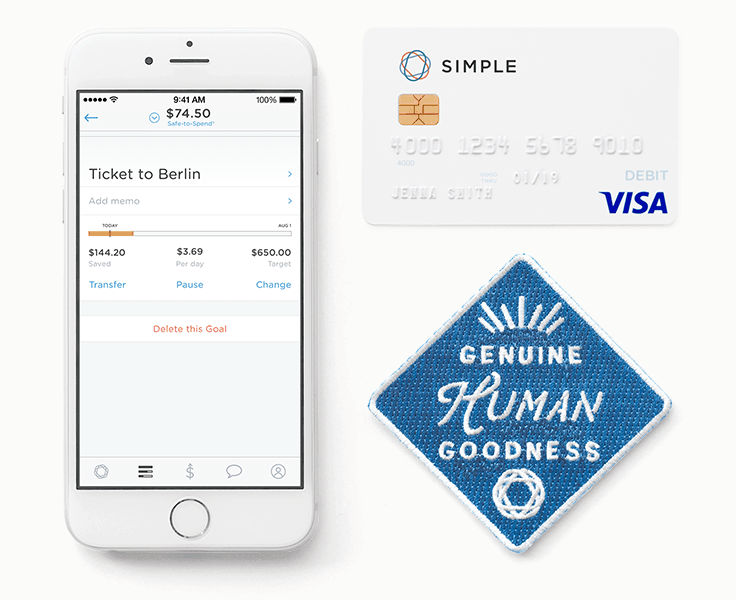

Simple

Source: Simple

True to its name, Simple is a banking app that aims to keep your financial affairs simple. It’s fee-free and comes with a VISA debit card.

The standout feature is its Safe-to-Spend tool, which tells you how much money you can really spare based on future bills. You can also set goals to keep yourself on track.

If you’re into a more detailed account of your spending, the app also gives you the ability to take photos and check-ins to each of your purchases. It’s best for those who don’t need cash or check deposits, although if you ever need to write a check, you can request it for free.

Wave

Source: iMore

Wave is an accounting tool that promises to stay free forever. As long as it lives up to this promise, it’s got an edge over other tools of its type.

In addition to handling expense tracking, invoices, receipt scanning and payments through credit cards – there’s a processing fee for this – it also has a premium payroll feature for small business owners. Apart from this service, the other features really are free and unlimited.

For cost-conscious freelancers, it’s a handy app to have on your phone.

![[Report] Beyond the Gig: Exploring Reliable Work Options for the Modern Workforce](https://info.wonolo.com/wp-content/uploads/2023/10/Worker-Preferences-Report-Header-Image-500x383.png)